High Performance Woodfired Ovens

- Bakery Wood Fired Ovens

- Communal Bar and Eat House

- Gas burner for Valoriani ovens

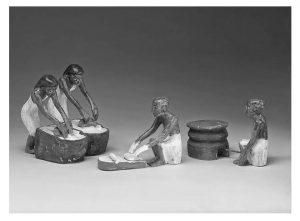

- The first traces of baking ovens date back to the time of ancient Egyptians

- The world famous Forni Valoriani woodfired ovens reached Kangaroo Island

- Lindemans Cafe

- Pizza Bamboo Boards are Back!

- Gift ideas for the home chef!

- Valoriani Forni Successful at HOST 2015

- Valoriani Oven on The Bachelor!

- Instant Asset Write-Off

- Coogee Pavilion

- Garden Pizza Oven: Baby Valoriani warms up your Autumn!

- Enrico Sgarbossa

- Verace Wood Fired Oven

Instant Asset Write-Off to Boost Small Business Spending.

Many restaurants, cafes, caterers and other companies within the food service industry are exactly the type of businesses the 2015 Budget wants to benefit. The increase to the instant asset write-off has jumped from $1,000 to $20,000 and was one of the biggest announcements of the budget. For suppliers of food service equipment and other Business to Business sales representatives this means now is the time to close those sales and encourage new start-ups and bigger investments.

What is the $20,000 Instant Asset Write-off?

“All small businesses will get an immediate tax deduction for any individual assets they buy costing less than $20,000.” – www.budget.gov.au

- The 100% tax deduction applies to any item used for running the business.

- The $20,000 limit applies to each individual item purchased.

- Purchases made between 7:30pm May 12th 2015 and June 30th 2017 can be claimed.

- There is no limit to how many items can be claimed by a business within this period.

What is the purpose of the new generous small business tax deductions?

- To encourage small businesses to invest in assets while the time is right

- Boost the economy

- Increase opportunity for small businesses

- Improve cash flow and bring forward investment

Who is eligible?

- Incorporated businesses.

- With an annual turnover of less than $2 million.

What equipment is covered?

- Any item used for running the business which includes Ovens, Refrigeration, Preparation benches, Mixers, Multi-function machinery, Tools and accessories.

What about items over $20,000?

- More expensive items may still be eligible for the normal small business depreciation arrangement.

- Small businesses also receive a tax cut of 1.5 percent (down to 28.5%) which is the lowest rate for small businesses in 50 years meaning more disposable funds for investment.